sales tax calculator tulsa ok

The current total local sales tax rate in Tulsa County OK is 4867. Tulsa OK Sales Tax Rate.

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

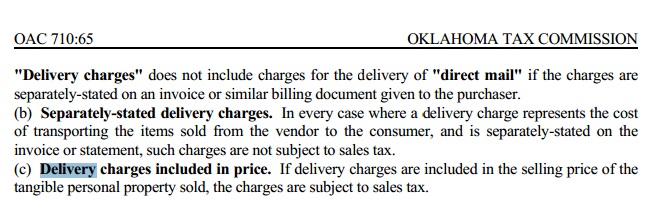

The Oklahoma sales tax rate is currently.

. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Sales Tax in Tulsa. Oklahoma State Tax Quick Facts.

You can calculate Sales Tax manually using the formula or use the Tulsa County Sales Tax Calculator or compare Sales Tax between different locations within. State of Oklahoma 45. The December 2020 total local sales tax rate was also 8517.

The calculator will show you the total sales tax amount as well as the. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Sales tax in Tulsa Oklahoma is currently 852.

The December 2020 total local sales tax rate was also. 087 average effective rate. The 8517 sales tax rate in tulsa consists of 45 oklahoma.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Oklahoma has recent rate changes Thu Jul 01 2021. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa Oklahoma Sales Tax. The current total local sales tax rate in Tulsa OK is 8517.

Sales tax in Tulsa County Oklahoma is currently 487. The 8517 sales tax rate in tulsa consists of 45 oklahoma. You can calculate Sales Tax manually using the formula or use the Tulsa Sales Tax Calculator or compare Sales Tax between different locations within Oklahoma.

With local taxes the total sales tax rate is between 4500 and 11500. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The average cumulative sales tax rate between all of them is 828. This is the total of state county and city sales tax rates. Just enter the five-digit zip.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. Average local state sales tax. Sales Tax Rate s c l sr.

As far as all cities towns and locations go the place with. The sales tax rate for Tulsa County was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tulsa OK.

OK Sales Tax Rate. Sales tax in tulsa oklahoma is currently 852. Average local state sales tax.

19 cents per gallon of regular gasoline and diesel. The most populous location in Tulsa County Oklahoma is Tulsa. Sales Tax Rate s c l sr.

The state sales tax rate in Oklahoma is 4500. Tulsa County OK Sales Tax Rate. Sales tax in tulsa oklahoma is currently 852.

Sales Tax Transaction Privilege Tax Queen Creek Az

3019 E 103rd St Tulsa Ok 74137 Mls 2228856 Redfin

Pull Factors A Measure Of Retail Sales Success Estimates For 77 Oklahoma Cities 2018 Oklahoma State University

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

Tax Forms Tax Information Tulsa Library

1 125 Sales Tax Calculator Template

Oklahoma Sales Tax Calculator And Economy 2022 Investomatica

Oklahoma Income Tax Calculator Smartasset

Where Are All Amazon Fulfillment Centers

Sales Tax Calculator Check Your State Sales Tax Rate

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)